| Home | News | Articles | News Releases | Classified Ads | Techpapers | Links | Contact US | Media Kit |

|

|||||||||

|

|

Wall Street Finally Recognizes Value of Nuclear Energy Firms

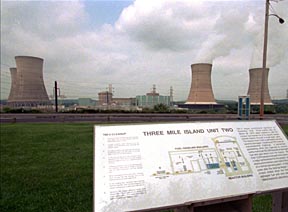

these aren't the Sixties or Seventies anymore. Nukes may finally be back in vogue. Utilities heavy into nuclear energy may become Wall Streetís hottest fair haired child. Years ago, when nuclear energy was new investment the investment professionals adored the utilities that went into the new technology. Then came Three Mile Island and Chernobyl, and the nuclear utilities became like lepers. They were sold off with no respect. The nuclear power industry accounts for 20 percent of the United States electricity generation. France being the geniuses they are have around 75 percent. There is increasing awareness that reliance on fossil fuels bring air pollution, acid rain, global warming as well as handing more power to OPEC. Recently, Vice President Dick Cheney, a former Texas oil executive, told the Nuclear Energy Institute that nuclear power has "a significant contribution to make going forward." For one thing, the number of reactors at already-licensed sites could be doubled according to the Bush administrationís new energy plan. That would avoid lengthy environmental battles. And the best science could be utilized to provide a deep geologic repository for nuclear waste, a still perplexing problem. " The Bush administration proposals have the potential of benefiting all nuclear operators, and in particular Exelon and Entergy," says Paul Patterson of Credit Suisse First Boston. Exelon has the largest nuclear portfolio in the United States, and Entergy is second, Patterson says. Exelon is the holding company of PECO Energy and Chicagoís Commonwealth Edison. "Exelon manages its nuclear fleet well," says David M. Reiner of Value Line, noting that capacity is high and refueling outages brief. "Management would like to bring on more nuclear generation," he says. The stock has doubled in the last year and a half. Keep in mind, however, that utilities in general had an excellent year in 2000, stumbled early this year, then improved. "Good news on nuclear is good news for Exelon," says Steven I. Fleishman of Merrill Lynch. One of the "cornerstones of the business (is) the low cost nuke portfolio." Management has taken "a contrarian and disciplined approach that has led to first mover initiatives in areas like nuclear acquisitions." Entergy serves a number of Southern states, including Arkansas and Louisiana. Late last year, it bought two nuclear plants and itís out to buy more. "Managementís strategy of buying a portfolio of nuclear plants is geared toward providing the operations with economies of scale," says Arthur H. Medalie of Value Line. The stock has almost tripled from early last year. The company was going to merge with Floridaís FPL Group, but the deal failed. Thatís one of the reasons FPL stock has underperformed of late, says Fleishman. Public Service Enterprise Group , which serves parts of New Jersey, is 55 percent nuclear. The stock has almost doubled since early last year and yields more than 4 percent. And, points out Fleishman, the company serves New York City, which may suffer California like electric woes this summer. The supply constraints in the Big Burg "may add some sizzle to Public Service Enterprise (Stock) come summer," enthuses Fleishman. Constellation Energy Group which serves the Maryland area, is more than 40 percent nuke. "Constellation already has an established track record for being a skillful operator of combined cycle plants," says Fleishman. And there will be more nuclear purchases, says Reiner. Some other electric utilities that are at least 30 percent nuclear are Public Service of New Mexico, FirstEnergy, Duke Energy, Dominion Resources, Central Vermont Public Service and El Paso Electric. Just remember that there are many other factors besides nuclear exposure that affect the price of their stocks.

|